Financial Services Market Competition Analysis 2025: How Players Are Shaping Growth

The Business Research Company’s Financial Services Global Market Report 2025 – Market Size, Trends, And Forecast 2025-2034

LONDON, GREATER LONDON, UNITED KINGDOM, December 23, 2025 /EINPresswire.com/ -- The Financial Services market is dominated by a mix of global banks, emerging fintech innovators, and digital-first financial platforms. Companies are increasingly focusing on customer-centric technologies, embedded finance solutions, and AI-driven automation to enhance competitiveness and operational efficiency. Understanding this evolving competitive landscape is essential for stakeholders looking to capitalize on new growth avenues and build strategic partnerships.

Which Market Player Is Leading the Financial Services Market?

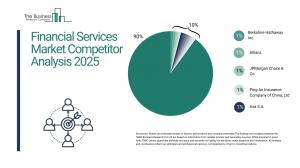

According to our research, Berkshire Hathaway Inc led global sales in 2023 with a 1% market share. The Insurance And Other division of the company partially involved in the financial services market, includes companies like GEICO and Berkshire Hathaway Reinsurance Group, offering a variety of insurance products such as auto, property, casualty and life insurance.

How Concentrated Is the Financial Services Market?

The market is fragmented, with the top 10 players accounting for 4% of total market revenue in 2023. This level of fragmentation reflects the industry’s broad competitive landscape shaped by diverse service categories, varied regional regulatory environments, and the presence of thousands of specialized institutions operating across banking, insurance, investment, and fintech domains. Leading players such as Berkshire Hathaway, Allianz, JPMorgan Chase, and Ping An maintain their positions through capital strength, diversified portfolios, global presence, and long-established customer trust, while numerous mid-sized and small firms cater to niche segments or regional needs. As digital transformation accelerates, driven by fintech innovation, embedded finance, and technology-enabled financial products, strategic partnerships, mergers, and ecosystem consolidation are expected to gradually increase the influence of major players, though the market is likely to remain broadly decentralized due to regulatory and structural diversity.

• Leading companies include:

o Berkshire Hathaway Inc (1%)

o Allianz (1%)

o JPMorgan Chase & Co (1%)

o Ping An Insurance Company of China, Ltd (1%)

o Axa S.A. (1%)

o Industrial and Commercial Bank of China (1%)

o China Construction Bank (1%)

o Bank of America Corporation (1%)

o Agricultural Bank of China (1%)

o China Life Insurance Company (1%)

Request a free sample of the Financial Services Market report

https://www.thebusinessresearchcompany.com/sample_request?id=1859&type=smp

Which Companies Are Leading Across Different Regions?

• North America: Grupo Financiero Banorte, Clara, Royal Bank of Canada (RBC), Fig Financial Inc, Munich Re, Fidelity Information Services (FIS), Estu, The Bank of New York Mellon Corporation, U.S. Agency for International Development (USAID), Franklin Resources Inc, Brookfield Asset Management Inc, BNY Mellon’s Pershing LLC, Franklin Resources Inc, CLEAR, Estu, Fidelity Information Services (FIS), CrowdStrike Holdings, Inc, Bank Midwest, Trump Media and Technology Group (TMTG), Velocity Clearing, LLC are leading companies in this region.

• Asia Pacific: Axis Bank, Bank of Baroda, BNL, FamPay, Federal Bank, Finin, HDFC Bank, Airwallex, American Express, ANZ, China Construction Bank (CCB), DBS Bank, ICBC Bank, Ant Financial, General Insurance Corporation of India (GIC Re), Fanhua Inc. (China), Velocity, Jio Financial Services Ltd, Life Insurance Corporation of India (LIC), Salesforce, Hitachi Payment Services Private Limited, China International Capital Corporation, China Galaxy Securities Co, Ltd, Asian Development Bank (ADB), Japan Post Holdings Co, Ltd, Bank Negara Malaysia (BNM), Webcash Global Co, Ltd, Zeller, TrueLayer, Kobble, Woori Bank Vietnam Limited, ICBC Financial Leasing Co, Ltd, UnionPay International (UPI), GoTo Financial, PayPay Corporation, Smartpay, HSBC Financial Services Fund, and Woori Financial Group are leading companies in this region.

• Western Europe: Ribbon Plc, Deutsche Bank, Magna Carta Wealth, FNZ, Unblu, RBC Brewin Dolphin, Alexander House Financial Services, Quilter, Sparkassen, Commerzbank, ING-DiBa, Arcano Partners, UBS Wealth Management, Raisin, Worldline SA, Brite Payments, Lydia, Santander Bank, N.A, Tink AB, Kivra, Adyen, Mambu, Ibercaja Banco, S.A, Trustly AB, NN Investment Partners, Ziglu Ltd, Fneek, Arthur J. Gallagher & Co, Willis Towers Watson plc, Lloyd's of London Limited, Aon Holding Deutschland GmbH, Funk Gruppe GmbH, Ecclesia Holding GmbH, Credit Kudos, Banca Ifis S.p.A, Klarna Bank AB, Finom, CaixaBank, S.A, Crédit Agricole Group are leading companies in this region.

• Eastern Europe: JP Morgan, Citigroup Inc, MONETA Money Bank, UniCredit S.p.A, ING Bank Romania, Black Sea Trade and Development Bank (BSTDB), Bank Gospodarstwa Krajowego (BGK), Santander Bank Polska S.A, European Investment Bank, Mitsubishi UFJ Financial Group, BNP Paribas, Velo BANK, Sberbank, ATON, BNP Paribas, Credit Suisse, Sberbank Rossii PAO, Raiffeisenbank a.s, Verestro S.A, BNP Paribas Bank, RCI Banque are leading companies in this region.

• South America: Ualá, Argentina’s Central Bank, Pismo, Nuvei Corporation, MOVii, Thunes Financial Services Inc, Columbia Banking System, Inc, Kuady, i2c, Banco de Crédito, Credicuotas, Pomelo, Fiserv Inc, Baaskit are leading companies in this region.

What Are the Major Competitive Trends in the Market?

• Digital Credit-As-A-Service is transforming prioritizing customer service while ensuring compliance with industry regulations.

• Example: Zeta digital credit-as-a-service (September 2024) assigns unique identities to enabling real-time, on-demand credit access through UPI payment applications.

• This innovative offering utilizes the National Payments Corporation of India's (NPCI) Credit Line on Unified Payments Interface (UPI) scheme.

Which Strategies Are Companies Adopting to Stay Ahead?

• Launching innovative embedded finance products to deepen customer engagement and expand cross-selling opportunities

• Enhancing data governance and cybersecurity frameworks to strengthen compliance and protect customer trust

• Focusing on hyper-personalized financial advisory services powered by advanced analytics and customer behaviour insights

• Leveraging open banking APIs and partner ecosystems to accelerate product integration and improve service delivery

Access the detailed Financial Services Market report here:

https://www.thebusinessresearchcompany.com/report/financial-services-global-market-report

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info"

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.